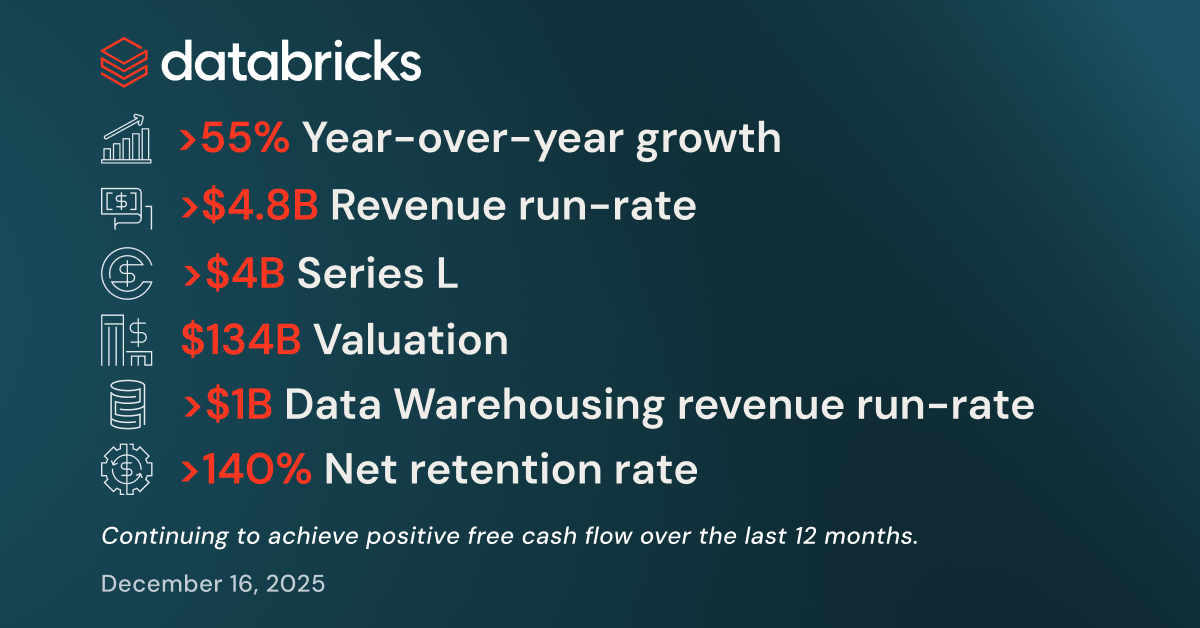

Databricks announced a massive $4 billion Series L funding round raised at a $134 billion valuation, underscoring the company's impressive growth in the data and AI sector. The round was led by Insight Partners, Fidelity, and J.P. Morgan Asset Management, with participation from Andreessen Horowitz, BlackRock, and other major investors.

The San Francisco-based company reported surpassing a $4.8 billion revenue run-rate in Q3 2025, representing over 55% year-over-year growth while maintaining positive free cash flow. Notably, Databricks has achieved over $1 billion in revenue run-rate from both its AI products and data warehousing business independently.

The funding will accelerate development of three strategic products for building "data intelligent applications": Lakebase, a serverless Postgres database designed for AI; Databricks Apps for deploying data and AI applications; and Agent Bricks for building multi-agent systems on proprietary data.

CEO Ali Ghodsi highlighted the convergence of generative AI with new coding paradigms as driving entirely new enterprise workloads. The company now serves over 20,000 organizations globally, including 60% of the Fortune 500, with more than 700 customers consuming over $1 million annually. The capital will also provide employee liquidity and support future AI acquisitions and research investments.

Comments