The collapse followed the explosive debut of DeepSeek AI, a Chinese startup whose free chatbot rapidly outperformed ChatGPT in Apple’s App Store, signaling a seismic shift in the AI sector. The tech-heavy Nasdaq tumbled 3.1%, while panicked investors dumped high-risk assets, triggering a slide in the U.S. dollar.

What Triggered the Selloff?

The crisis erupted after DeepSeek AI, a Beijing-based firm, launched an AI assistant that combines advanced capabilities with cost-effective operation. Unlike premium alternatives like ChatGPT, which rely on expensive infrastructure, DeepSeek’s model reportedly operates at a fraction of the cost while matching—or exceeding—competitors in tasks like coding, research, and multilingual support. Within days of its release, the app surged to the top of download charts in over 50 countries, alarming investors about Big Tech’s ability to maintain dominance amid rising global competition.

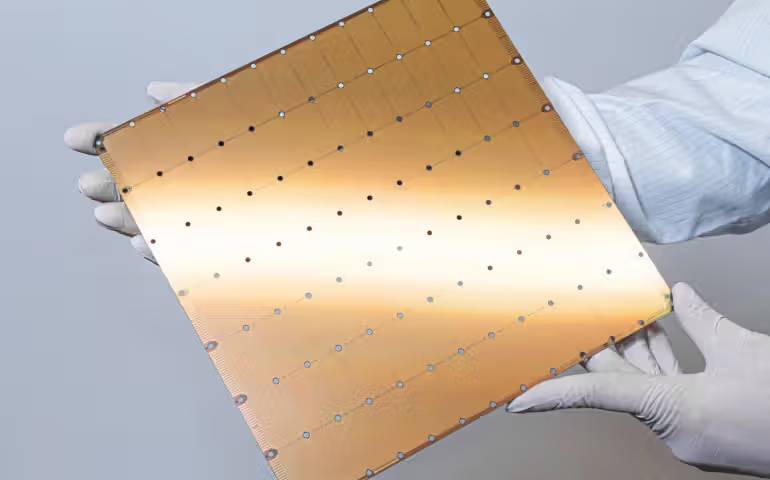

Why Did Nvidia Bear the Brunt?

As the primary supplier of GPUs powering AI systems like ChatGPT, Nvidia has been a linchpin of the AI boom. However, DeepSeek’s rapid adoption exposed vulnerabilities:

- Cost Concerns: DeepSeek’s budget-friendly model relies on optimized algorithms and cheaper hardware, reducing dependence on Nvidia’s high-end chips.

- Market Saturation: Analysts warn that demand for Nvidia’s products may plateau as companies prioritize efficiency over raw computing power.

- Investor Psychology: The selloff amplified fears that Nvidia’s sky-high valuation (up 200% in 2023) had outpaced realistic growth prospects.

The panic was compounded by Nvidia’s 17% single-day stock plunge—double its previous record drop in March 2024—which alone accounted for 40% of the Nasdaq’s decline.

Key Factors Behind DeepSeek’s Disruption

Early adopters and analysts highlight three advantages driving DeepSeek’s success:

- Affordability: Operates on low-cost infrastructure, appealing to startups and cost-conscious enterprises.

- Localization: Superior multilingual support, including nuanced Mandarin, Hindi, and Spanish comprehension.

- Niche Performance: Outperforms rivals in coding and data analysis tasks critical for business users.

DeepSeek’s rise mirrors China’s broader push to lead AI innovation, with government-backed initiatives accelerating domestic tech self-reliance.

What’s Next for Tech Stocks?

Market volatility is expected to persist as investors reassess AI valuations. Nvidia CEO Jensen Huang acknowledged the “challenging landscape” in a late Monday statement, hinting at price adjustments and partnerships to retain market share. Meanwhile, rivals like AMD and Intel face parallel pressures, with semiconductor stocks collectively losing $1.2 trillion.

Goldman Sachs analysts predict a “reckoning” for AI-focused firms, urging diversification into defensive sectors like utilities and consumer staples. However, some contrarians view the crash as a buying opportunity, citing AI’s long-term potential.

Conclusion

The market rout underscores a harsh truth: innovation waits for no one. As low-cost disruptors like DeepSeek rewrite the rules, even trillion-dollar tech giants must adapt or risk obsolescence. While Nvidia’s stumble marks a historic moment, it also highlights the AI sector’s relentless evolution—where today’s leader can quickly become tomorrow’s cautionary tale. Now more than ever, investors are learning that in the age of AI, there’s no such thing as a safe bet.

Comments