Lightmatter raised $400M to advance its photonic interconnect technology

Lightmatter secured $400 million in Series D funding to accelerate the deployment of its Passage product. Passage uses photonics technology to overcome chip interconnection bottlenecks in AI and HPC workloads, potentially revolutionizing data center performance and efficiency.

Given the rapid pace at which (generative) AI is advancing lately, it is hard to believe that one of the obstacles to scaling AI is the issue of connecting (racks of) chips without introducing significant latency increases. However, having to squeeze the computing power of hundreds or thousands of chips through to traditional networking switches is real, establishing itself as a roadblock for scalable and energy-efficient performance, since the layered structure of switches and chip interconnects increases both latency and energy consumption as demands for increased computing resources are addressed by connecting more and more processing units.

Lightmatter, a leading photonics supercomputing company, has been working on solving these bottlenecks for some time. The company recently announced it has closed a $400 million Series D funding round at a valuation of $4.4 billion, for a total of $850 million raised funds. The Series D was led by new investors advised by T. Rowe Price Associates, Inc., and existing investors including Fidelity Management & Research Company and GV (Google Ventures) participated in the round. Lightmatter has stated that the new financing will accelerate the deployment of its Passage product in partner data centers, breaking the barriers to scalable and efficient AI workload performance.

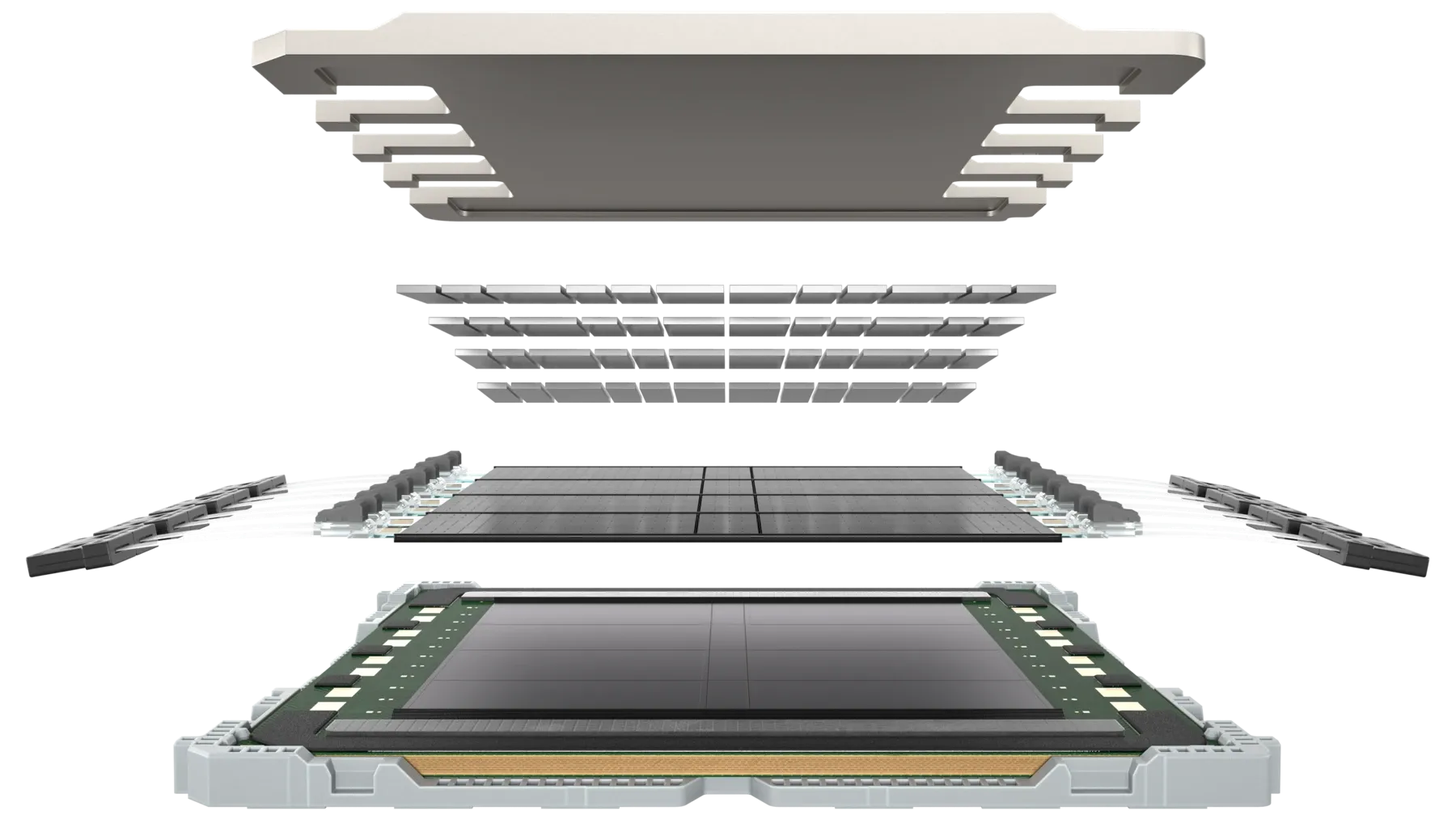

Passage allows the 3D integration of thousands to millions of processing units (GPUs, accelerators) onto a multi-reticle optical ‘interposer’ which, together with ultra-dense fiber attach and fully integrated control circuitry, delivers unprecedented bandwidth speeds and enables supercomputers with over one million nodes. Simultaneously, the simplified infrastructure provided by Passage translates to reduced power consumption and unlocks the scalability required for next-generation AI and HPC workloads, including trillion parameter models.

Representatives for the T. Rowe Price Science & Technology Fund and GV remarked on Lightmatter's success over the last six years. Tony Wang, portfolio manager of the T. Rowe Price Science & Technology Fund commented on the growing demand for AI supercomputers and Lightmatter's status as a leader in photonics supercomputing as key factors supporting the Fund's decision to invest in the company. Similarly, Erik Nordlander, General Partner at GV, recognized the potential of photonics to drive the next generation of data center technology and remarked that GV's belief in Lightmatter's vision had only strengthened, having supported the company since its inception.