There's more to the 'AI boom' than foundational model companies

The AI boom is often associated with the lightning-fast rise of foundational model companies like OpenAI. Once more, NVIDIA reminds us that hardware is also important, as its groundbreaking financial growth shines its light upon other AI hardware-related stocks.

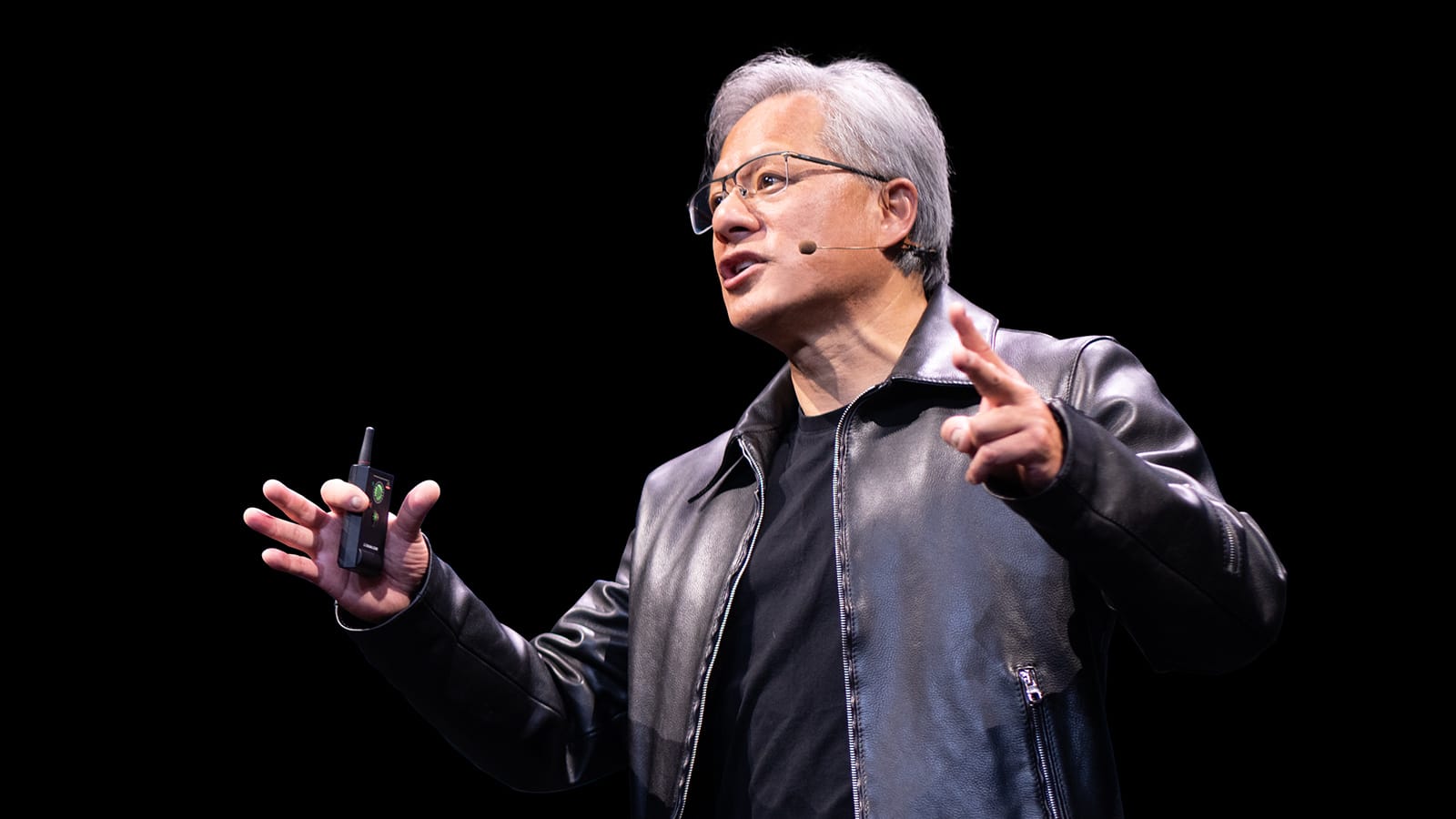

Lately, the AI boom seems to be all about the most recent installment of the Elon Musk vs. OpenAI feud, Anthropic's financial well-being, or even Mistral AI's meteoric rise to fame. And, now and then, NVIDIA reminds us about its dominance on the hardware front (partly because of its software, as it turns out). However, a picture that only features these players is only scratching the surface of the reach that the current 'AI boom' has had in some of the farthest corners of the industry.

Take, for instance, Dell. Right after Jensen Huang's keynote at NVIDIA's GTC, it was noted that Dell Founder and CEO Michael Dell was seen waving from the front row right when Huang joked that he would be available to take orders for new equipment capable of running NVIDIA's latest Blackwell technology. Dell's stock price has risen steadily since the beginning of the year and even featured a $30, over 30% increase on March 1. Dell is a critical partner for NVIDIA in getting its technology everywhere, but it is not the only valuable one. Server specialist Super Micro's run may not be as impressive as Dell's, but its stock price has also seen a three-fold increase in price since the start of 2024. Finally, since announcing it would start shipping its latest AI chips last December, chipmaker AMD has tripled its market value from $100B to $292B, which outshines any proprietary foundation model valuation.

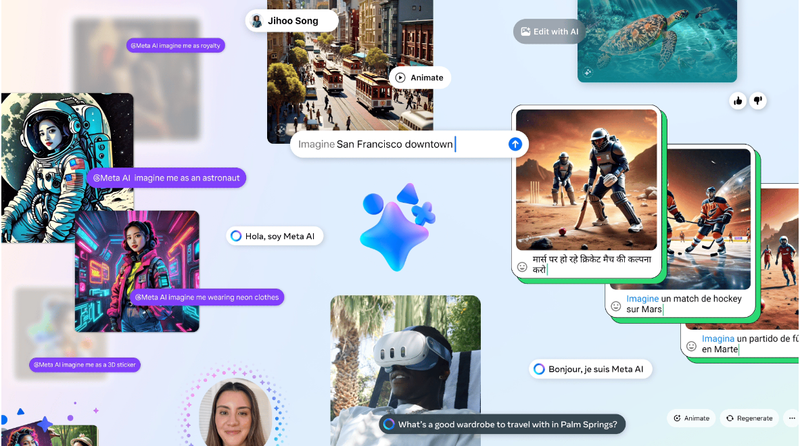

In the end, it all falls back to demand. In the particular case of servers, a 50% increase in demand for AI-specialized equipment has kept the sales figures for the most prominent suppliers growing, and will reportedly continue to do so until around the end of 2027. And while the AI boom has not benefitted every tech giant equally —Intel keeps slogging through its attempt at a turnaround— there is also the concern of whether the pace of the demand for AI-optimized hardware and applications can be held long enough or reach a size that justifies the market's current optimism. Similarly to Intel, Adobe is struggling to get its foot into the generative AI door. The company was expected to experience a sales boost after introducing its AI-powered tool suites. However, the reality has failed to live up to the expectation, leading to a stock price drop after the company announced it expects a downturn in its annual recurring revenue for the digital media segment, which includes its document and creative solutions on the cloud.

A recurring related topic has been the caution with which enterprise and business AI spending has proceeded as of late. Andreessen Horowitz recently published a report that included promising shifts in the patterns of AI spending within organizations. The report authors found that enterprises were slowly abandoning one-time funding pools and innovation budgets in favor of more stable recurring line items from IT and non-IT allocations. Still, others found that the change was not taking place fast enough to rule out that the AI hype hypothesis was starting to show its face: although companies are planning to shift their AI spending from proof of concepts coming from innovation budgets to recurring line items, the implementation of these measures will still take time, two to three years, according to some calculations.